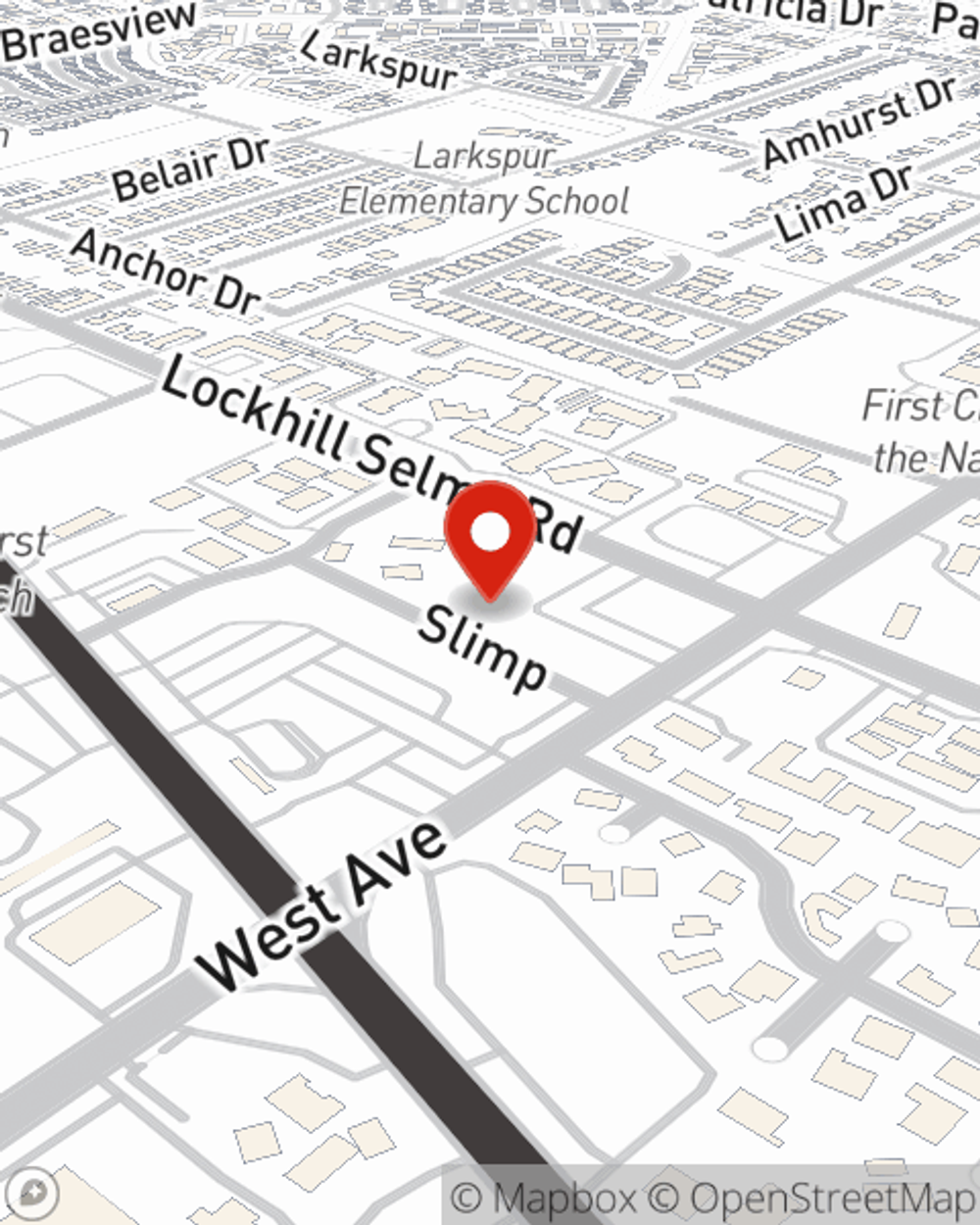

Homeowners Insurance in and around Castle Hills

Castle Hills, make sure your house has a strong foundation with coverage from State Farm.

Give your home an extra layer of protection with State Farm home insurance.

Would you like to create a personalized homeowners quote?

- San Antonio, Texas

- Castle Hills, Texas

- Helotes, Texas

- Leon Valley, Texas

- Boerne, Texas

- Castroville, Texas

- Devine, Texas

- Lytle, Texas

- Cibolo, Texas

- Selma, Texas

- El Campo, Texas

- Bay City, Texas

- Bexar County, Texas

- Wharton County, TX

- Matagorda County, TX

- Shavano, Texas

- Alamo Heights, Texas

- Fair Oaks Ranch

- Schertz, Texas

- Freeport, Texas

- Lake Jackson, Texas

- Port La Vaca, Texas

- Universal City, TX

- Santa Fe, Texas

What's More Important Than A Secure Home?

Committing to homeownership is a big responsibility. You need to consider cosmetic fixes location and more. But once you find the perfect place to call home, you also need outstanding insurance. Finding the right coverage can help your Castle Hills home be a sweet place to be.

Castle Hills, make sure your house has a strong foundation with coverage from State Farm.

Give your home an extra layer of protection with State Farm home insurance.

Homeowners Insurance You Can Trust

You’ll get that and more with State Farm homeowner’s insurance. State Farm has coverage options to keep your largest asset safe. You’ll get a policy that’s personalized to accommodate your specific needs. Fortunately you won’t have to figure that out alone. With true commitment and terrific customer service, Agent Trey Solis can walk you through every step to build a policy that safeguards your home and everything you’ve invested in.

Having great homeowners insurance can be significant to have for when the unpredictable occurs. Reach out to agent Trey Solis's office today to figure out what works for your home insurance needs.

Have More Questions About Homeowners Insurance?

Call Trey at (210) 616-2056 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Pros and cons of metal roofs for your home

Pros and cons of metal roofs for your home

The benefits of a metal roof may outweigh traditional asphalt shingles, especially when you consider a metal roof lifespan.

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.

Simple Insights®

Pros and cons of metal roofs for your home

Pros and cons of metal roofs for your home

The benefits of a metal roof may outweigh traditional asphalt shingles, especially when you consider a metal roof lifespan.

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.